The insurance industry hasn’t historically been known for its digital prowess. Instead, it’s been laser-focused on maintaining long-standing legacies with stability, professionalism, and support.

But as in-person meetings continue to fall by the wayside and younger customers prefer digital interactions, what was once a choice is now an imperative: Insurance companies must digitize experiences or risk attrition from savvy consumers.

That’s most likely why improving the customer experience and operational excellence now top the list of insurance digitalization initiatives for 2023—not revenue growth.

But insurance agency workflow procedures are likely to be heavily manual and ingrained in company culture. So, how can you compete in the era of digital insurance? You can start by creating automated insurance workflows with Formstack.

Creating Insurance Workflows with Formstack

Insurance workflow automation removes the need for paper shuffling and signature gathering, replacing them instead with secure, digital workflows that keep your entire team connected and productive.

Formstack’s workflow automation platform includes secure online forms, automated document generation, and electronic signatures. The best part? You don’t have to be a coding wizard to implement them. Our suite of no-code products allows you to set up workflows for quote proposals, lead generation, appointment booking, contracts, and much more with drag-and-drop ease.

Used to software overhauls and projects that take your team months or years to implement? Formstack helps you create the digital workflows your team and customers desire in just minutes.

All of the workflows below are easily built within Formstack’s suite of workplace productivity tools. With Formstack, you can automate the processes that matter most to your organization and customers—securely, in the cloud, and without code.

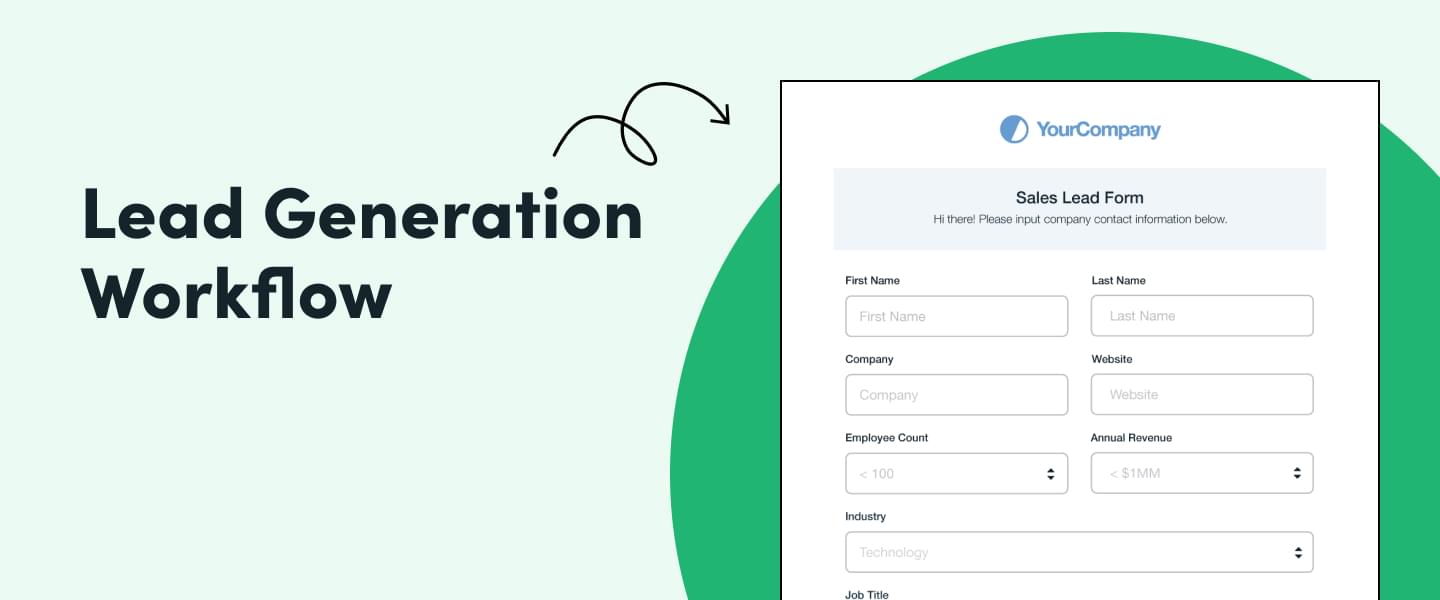

Lead Generation Workflow

Research shows that today’s insurance customers are extremely fickle when it comes to staying with a carrier. Numerous competing options give them the freedom to jump ship at any time if they aren’t satisfied with their experience.

So when a new potential customer comes along, it’s your job to wow them—not with fancy benefits or unrealistic quotes, but with seamless, hassle-free processes that give them a taste of what it’s like to work with you.

Step 1: Lead Generation

Create a lead generation form that quickly and easily captures new prospects looking to set up a meeting. Start with our pre-built sales lead template, then brand the form so newcomers enjoy a consistent experience throughout the booking process. Then, save time emailing back and forth to set up a meeting by integrating your Google calendar. Using a form that’s mobile-optimized will also enhance the new customer experience, as mobile queries that contain “insurance near me” have grown by over 100% in the past few years.

Step 2: Assignment Workflow

Here’s where automation works its magic. After receiving a new form submission, a workflow automatically assigns the lead to the right agent depending on criteria you set. Plus, it simultaneously sends the information to your insurance CRM—so you don’t have to enter it manually. No need to remember to follow up with the prospect either. Trigger emails and notifications that confirm receipt of their form.

Pro Tip: Already use Salesforce? Consider building this workflow with our native Salesforce tool, Formstack for Salesforce, which combines forms, documents, and eSignatures into your existing ecosystem.

Step 3: Client Onboarding

Once an agent is assigned to the lead, trigger an onboarding packet so new clients have all the necessary forms and documents they’ll need to fill out before your first meeting. This may include basic information forms, agreements, beneficiary forms, and even a branded welcome letter so they can get to know your company and what to expect.

Read Next: How to Gain and Retain Insurance Industry Customers

Quote Proposal Workflow

When consumers are used to shopping for insurance online with instant calculators and live responses, it’s no wonder they expect quotes in record time too. Impress new leads from the get-go with an automated workflow that puts quotes together in minutes, not days or weeks. Instead of consulting multiple insurance tools or delaying tasks in employee inboxes, let integrations and approval routing do it for you.

Step 1: Estimate Request

Place an estimate request form directly on your website so new customers can get the process started right away. Tailor our pre-built estimate template with the insurance types you offer, coverage ranges, and other information you may want to know, like the applicant’s current provider. Easily drag and drop as many fields as you need, from first and last name to radio buttons for multiple choice selection or short answer for deeper explanations. Be sure to add conditional logic to change calculations behind the scenes and make new fields appear when applicants say they meet certain conditions. This reduces the number of necessary questions, improving the customer experience with a shorter form.

Step 2: Quote Generation

After submission, display a custom message or redirect applicants to another web page to keep them engaged on your site. Set up a custom workflow to automatically route form data to the most relevant departments and team members. You can even use APIs to securely send and receive data from your quoting software—all from one interface. Need to run it by a manager for quality assurance first? Set up an approvals workflow before sending back to the prospect.

Watch: How to Generate and Sign Insurance Quotes With the Formstack Platform

Step 3: Quote Proposal

Present applicants with a professional proposal outlining their coverage dates, rates, and conditions. With Formstack, there’s no reason to manually pull data into a Word document or other software. Simply generate a pre-populated proposal using all the data you’ve already collected. Then, seal the deal with an electronic signature your new client can fill out from anywhere.

Practically Genius: Hear how Great Plains Brokerage streamlined the entire insurance quoting process.

Contract Workflow

It’s easy for the customer experience to get lost in the shuffle when you’re printing, faxing, signing, and mailing as part of traditional insurance agency workflow procedures. And if applicants have been shopping for quotes with other agencies, this is where they’re most at risk for jumping ship. Streamline and accelerate the closing process with insurance workflow automation that makes it easy to sign and start coverage.

Step 1: Certificate of Insurance

Generate your final certificate of insurance and easily share with customers. Automation ensures these important documents aren’t affected by data re-entry or human error. Plus, Formstack Documents has many native integrations that make it easy to work into any of your existing processes, workflows, or tech stacks while upholding data privacy and compliance. Protect client data with robust security features, including password-protected downloads, data encryption, SSL, and HIPAA compliance on life and medical insurance documents.

Step 2: Contract Signing

Use Formstack Sign to safely collect necessary eSignatures for policies, agreements, conditions, and more from any device. Give clients the flexibility to choose between email, mobile, or in-office signing for the utmost convenience. Once completed, send signed documents to systems like Applied, Vertafore, NASA, and QQSolutions for seamless data storage.

Step 3: Customer Onboarding and Feedback

Go the extra mile by welcoming your new policyholders with a digital onboarding packet. Include branded materials that give customers a sense of your company, and include important documents leading them to channels for support. Then, invite your new members to share feedback on the inquiry and quoting process so you can continually improve.

Win More Customers With Insurance Workflow Automation

Start attracting and retaining more customers by meeting their expectations for fast, digital service with ease. Instead of doing all the work behind the scenes, let Formstack transform your entire insurance quote process, from initial inquiry to quote documentation—all from a single platform.

Discover how the Formstack Platform can make your insurance workflows more efficient than ever. Start a trial or request a demo today.